Post by ALGER on Jun 18, 2017 2:24:25 GMT

Is The People's Bank Of China Manipulating The Bitcoin Price?

China’s dominance of the bitcoin network is incredibly concerning to the digital currency’s techno-libertarian purists, who fear that the concentration of mining power in the world’s second-largest economy is threatening to subvert bitcoin’s democratic nature. With more than half of the network’s hashing power resting in their hands, giant Chinese mining pools like AntPool, Bitmain and the other massive bitcoin-mining conglomerates can effectively monopolize control over the bitcoin blockchain.

Given bitcoin’s stated aim – to bypass the authority of central banks and governments and return control of the world’s money supply to individuals – many have noted the incongruity between the currency’s democratic aspirations, and the Chinese government’s apparent willingness to tolerate, and even nurture, the country’s bitcoin industry.

“Bitcoin Uncensored” explained one theory for the Chinese government's embrace of bitcoin: The People’s Bank of China is using its jawboning powers to manipulate the price of the digital currency to benefit politically connected elites.

“The CCP is not out to kill bitcoin – at least not right now. Since China can have such a huge impact on the price of bitcoin, why wouldn’t the Chinese government use this power to its advantage? Chinese government regulators can, in theory, exert a huge influence on the global price of bitcoin. So, if you own bitcoin, well, the value of your money can be heavily influenced by the whims of the world’s largest authoritarian regime.”

As the theory goes, the massive swings in bitcoin’s valuation witnessed back in 2013 were engineered by the PBOC when authorities prohibited local financial institutions from dealing in the digital currency. In early September of that year, one bitcoin was worth $100. By late November, the price had ballooned to $1,000. Then the price came crashing down seemingly overnight. Chinese authorities were widely blamed for the drop, which created what should’ve been an incredible buying opportunity.

But whatever the PBOC’s plans might’ve been, they were disrupted by the collapse of Japanese bitcoin exchange Mt. Gox, which ushered in a bear market that endured until late 2015.

However, more than two years later, Chinese authorities again resorted to jawboning to influence the bitcoin price when they announced in January that they were investigating the country’s digital currency exchanges. After forcing the three biggest exchanges in the country, BTCC, Huobi and OKCoin, trading volumes in China dissipated and the price fell – though not by as much as in 2013, creating yet another buying opportunity. But the time withdrawals were reinstated four months later, the digital currency had climbed to all-time highs, driven largely by an influx of Japanese and South Korean retail investors who have been enticed by the promise of exponential returns during the modern low-interest rate environment.

Of course, Chinese authorities have plenty of other reasons to try and control the bitcoin market. Here’s BU with more:

“So why has the Chinese regime been targeting bitcoin other than it being a democratic currency? There are a few reasons. First Chinese people can use bitcoin to get their money out of China. The Chinese regime has limits on the amount of foreign currency people can buy. But Chinese investors can buy bitcoin in China then later exchange that for foreign currency in any amount they want.

Huge fortunes that might be made through corruption could be safely stored out of reach of China’s pesky investigators. That is why China’s central bank started investigating bitcoin exchanges back in February, and threatened to shut down exchanges that violated rules on foreign exchange payments and settlement. That was why China’s central bank started investigating bitcoin exchanges back in February and threatened to shut down exchanges that violated rules on foreign exchange management, money laundering and payment and settlement.

To be sure, it’s unclear how much money is being moved out of China through bitcoin. Bitcoin transactions in China are not anonymous since you have to link a Chinese bank card to your bitcoin account. You could move a few thousand yuan, but large amounts would attract attention.”

Should it choose to use it, Chinese authorities have at their disposal what BU describes as “the ultimate sword of Damocles.”

“The Chinese government has the ultimate sword of Damocles over bitcoin operations in China. Chinese regulators could crack down on bitcoin by classifying it as a foreign currency which would limit individual transactions to $50,000 a year.”

While the Chinese government could easily crush the bitcoin market, it hasn’t because that would allow miners in other countries to usurp its dominance – something the PBOC might find difficult to undo. China is home to between 50% and 70% of the world’s bitcoin mining operations, BU reports.

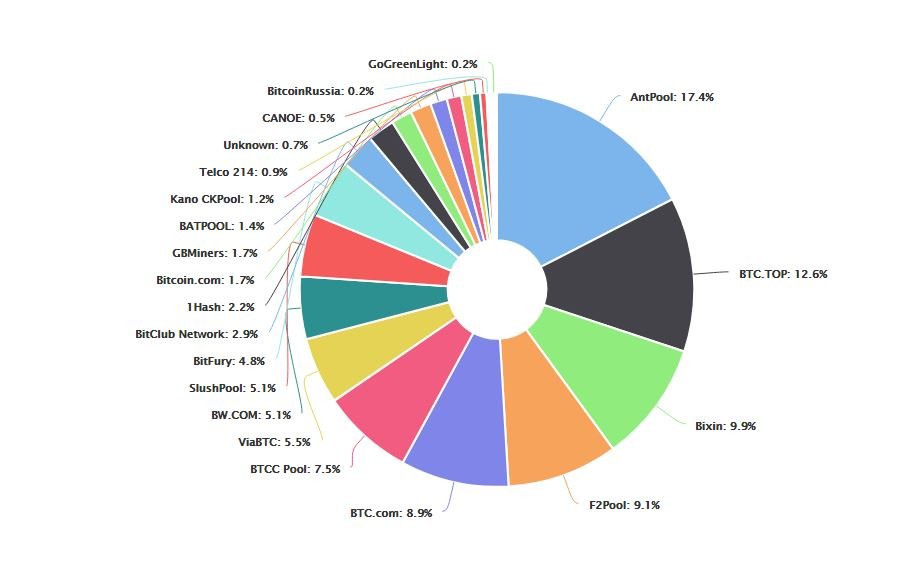

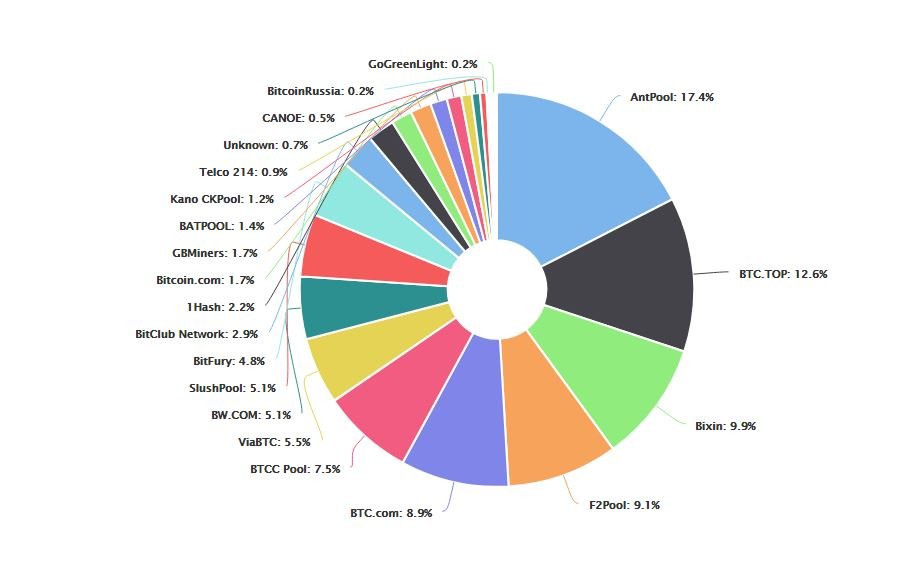

Below is chart illustrates the bitcoin network's hashrate distribution by mining pool. As the graphic clearly shows, Chinese pools control more than half of the network's power, though the exact percentage is in constant flux because miners are constantly competing to process the next block of transactions: (source: blockchain.info)

Instead of cracking down on the mining community, the Chinese government has been effectively propping it up by supplying its miners with cheap electricity.

Major bitcoin mines in China’s northwest are being given access to government supported low cost wind and solar power. Powering the computer servers needed to mine digital currencies is one of the biggest financial challenges that bitcoin miners face. The PBOC’s logic here is easy to spot: The more bitcoin miners who set up shop in the China, the greater the control the PBOC exercises over the global bitcoin market.

Lingering fears of a crackdown have only served to benefit the government’s position. As BU explains:

“A lot of people feel they should buy as much bitcoin as they can right now, which will of course further drive up the price, possibly making officials very rich.”

****

After bitcoin plunged to a two-week low earlier Thursday, CNBC and a handful of other media organizations blamed the latest drop on a trifecta of reasons ranging from cyberattacks to new regulations that are presently being debated by US Congress. An outline of their reasoning can be found below:

Cyber attack

As CNBC reports, major bitcoin exchanges were hit with multiple cyberattacks this week. Bitfinex, the largest U.S. dollar based bitcoin exchange, announced it was under ‘distributed denial-of-service’ attacks (DDOS) which slowed the service down. The attacks come at a time when consumer interest in bitcoins have also led to heavier than normal traffic on the exchanges, compounding the attacks.

We are currently running slow due to a DDoS attack, hang tight while we make some adjustments to speed it up. #bitcoin #localbitcoins— LocalBitcoins.com (@localbitcoins) August 16, 2016

Platform upgrade

On August 1st, the bitcoin platform will be undergoing a protocol upgrade labeled BIP148, meant to solve the block size debate – an argument over the size of bitcoin’s ‘blocks’ (a record of transactions on the public ledger – the ‘blockchain’). The planned improvements are supposed to help ‘scale’ bitcoin for future growth, lower fees, and speed up transaction times – however the upgrade is not without risks, and the Bitcoin community is divided.

#Bitcoin scaling negotiations / compromises are over.

Either we support BIP148 and save Bitcoin from destruction or 8 years gone to waste. ?— Hisham Fahmy (@fahmyeu) June 14, 2017

?— Hisham Fahmy (@fahmyeu) June 14, 2017

Whether we like it or not, at this point not supporting BIP148 is the dangerous path. With most risks being to miners & services, not users.— Neo M. Atrix (@redpilltrading) June 4, 2017

Inclusion in Anti-Money Laundering Bill:

Last but not least, Senators Chuck Grassley (R-IA), Dianne Feinstein (D-CA), John Cornyn (R-TX) and Sheldon Whitehouse (D-RI) have co-sponsored bill S.1241 (Combating Money Laundering, Terrorist Financing and Counterfeiting Act), which adds language to existing anti-money laundering provisions to include digital wallets, prepaid access devices, and other ‘digital currency exchangers’ if they contain over $10,000 of cryptocurrency. Also included in the bill are cell phones, flash drives, and computers containing information on holdings which will need to be declared and reported upon entry into the U.S. In other words, the notion of using digital currency to transact anonymously will become much less attractive if this bill is signed into law.

Demand for cryptocurrencies has skyrocketed over the last few months, beginning with Japan recognizing bitcoin as legal currency in April. Other countries including South Korea and Malaysia are reportedly set to follow suit.

Chinese leader Xi Jinping has vowed to combat corruption among China’s business and political elite – a crackdown that recently led to the detention of the CEO of Anbang, China's hyperacquisitive insurance conglomerate. The company has been blamed for a sizable portion of China's merger spree between 2014 and 2016, and which has since been accused of being a money laundering vehicle, of wreaking "havoc" with the Chinese insurance market.

China’s dominance of the bitcoin network is incredibly concerning to the digital currency’s techno-libertarian purists, who fear that the concentration of mining power in the world’s second-largest economy is threatening to subvert bitcoin’s democratic nature. With more than half of the network’s hashing power resting in their hands, giant Chinese mining pools like AntPool, Bitmain and the other massive bitcoin-mining conglomerates can effectively monopolize control over the bitcoin blockchain.

Given bitcoin’s stated aim – to bypass the authority of central banks and governments and return control of the world’s money supply to individuals – many have noted the incongruity between the currency’s democratic aspirations, and the Chinese government’s apparent willingness to tolerate, and even nurture, the country’s bitcoin industry.

“Bitcoin Uncensored” explained one theory for the Chinese government's embrace of bitcoin: The People’s Bank of China is using its jawboning powers to manipulate the price of the digital currency to benefit politically connected elites.

“The CCP is not out to kill bitcoin – at least not right now. Since China can have such a huge impact on the price of bitcoin, why wouldn’t the Chinese government use this power to its advantage? Chinese government regulators can, in theory, exert a huge influence on the global price of bitcoin. So, if you own bitcoin, well, the value of your money can be heavily influenced by the whims of the world’s largest authoritarian regime.”

As the theory goes, the massive swings in bitcoin’s valuation witnessed back in 2013 were engineered by the PBOC when authorities prohibited local financial institutions from dealing in the digital currency. In early September of that year, one bitcoin was worth $100. By late November, the price had ballooned to $1,000. Then the price came crashing down seemingly overnight. Chinese authorities were widely blamed for the drop, which created what should’ve been an incredible buying opportunity.

But whatever the PBOC’s plans might’ve been, they were disrupted by the collapse of Japanese bitcoin exchange Mt. Gox, which ushered in a bear market that endured until late 2015.

However, more than two years later, Chinese authorities again resorted to jawboning to influence the bitcoin price when they announced in January that they were investigating the country’s digital currency exchanges. After forcing the three biggest exchanges in the country, BTCC, Huobi and OKCoin, trading volumes in China dissipated and the price fell – though not by as much as in 2013, creating yet another buying opportunity. But the time withdrawals were reinstated four months later, the digital currency had climbed to all-time highs, driven largely by an influx of Japanese and South Korean retail investors who have been enticed by the promise of exponential returns during the modern low-interest rate environment.

Of course, Chinese authorities have plenty of other reasons to try and control the bitcoin market. Here’s BU with more:

“So why has the Chinese regime been targeting bitcoin other than it being a democratic currency? There are a few reasons. First Chinese people can use bitcoin to get their money out of China. The Chinese regime has limits on the amount of foreign currency people can buy. But Chinese investors can buy bitcoin in China then later exchange that for foreign currency in any amount they want.

Huge fortunes that might be made through corruption could be safely stored out of reach of China’s pesky investigators. That is why China’s central bank started investigating bitcoin exchanges back in February, and threatened to shut down exchanges that violated rules on foreign exchange payments and settlement. That was why China’s central bank started investigating bitcoin exchanges back in February and threatened to shut down exchanges that violated rules on foreign exchange management, money laundering and payment and settlement.

To be sure, it’s unclear how much money is being moved out of China through bitcoin. Bitcoin transactions in China are not anonymous since you have to link a Chinese bank card to your bitcoin account. You could move a few thousand yuan, but large amounts would attract attention.”

Should it choose to use it, Chinese authorities have at their disposal what BU describes as “the ultimate sword of Damocles.”

“The Chinese government has the ultimate sword of Damocles over bitcoin operations in China. Chinese regulators could crack down on bitcoin by classifying it as a foreign currency which would limit individual transactions to $50,000 a year.”

While the Chinese government could easily crush the bitcoin market, it hasn’t because that would allow miners in other countries to usurp its dominance – something the PBOC might find difficult to undo. China is home to between 50% and 70% of the world’s bitcoin mining operations, BU reports.

Below is chart illustrates the bitcoin network's hashrate distribution by mining pool. As the graphic clearly shows, Chinese pools control more than half of the network's power, though the exact percentage is in constant flux because miners are constantly competing to process the next block of transactions: (source: blockchain.info)

Instead of cracking down on the mining community, the Chinese government has been effectively propping it up by supplying its miners with cheap electricity.

Major bitcoin mines in China’s northwest are being given access to government supported low cost wind and solar power. Powering the computer servers needed to mine digital currencies is one of the biggest financial challenges that bitcoin miners face. The PBOC’s logic here is easy to spot: The more bitcoin miners who set up shop in the China, the greater the control the PBOC exercises over the global bitcoin market.

Lingering fears of a crackdown have only served to benefit the government’s position. As BU explains:

“A lot of people feel they should buy as much bitcoin as they can right now, which will of course further drive up the price, possibly making officials very rich.”

****

After bitcoin plunged to a two-week low earlier Thursday, CNBC and a handful of other media organizations blamed the latest drop on a trifecta of reasons ranging from cyberattacks to new regulations that are presently being debated by US Congress. An outline of their reasoning can be found below:

Cyber attack

As CNBC reports, major bitcoin exchanges were hit with multiple cyberattacks this week. Bitfinex, the largest U.S. dollar based bitcoin exchange, announced it was under ‘distributed denial-of-service’ attacks (DDOS) which slowed the service down. The attacks come at a time when consumer interest in bitcoins have also led to heavier than normal traffic on the exchanges, compounding the attacks.

We are currently running slow due to a DDoS attack, hang tight while we make some adjustments to speed it up. #bitcoin #localbitcoins— LocalBitcoins.com (@localbitcoins) August 16, 2016

Platform upgrade

On August 1st, the bitcoin platform will be undergoing a protocol upgrade labeled BIP148, meant to solve the block size debate – an argument over the size of bitcoin’s ‘blocks’ (a record of transactions on the public ledger – the ‘blockchain’). The planned improvements are supposed to help ‘scale’ bitcoin for future growth, lower fees, and speed up transaction times – however the upgrade is not without risks, and the Bitcoin community is divided.

#Bitcoin scaling negotiations / compromises are over.

Either we support BIP148 and save Bitcoin from destruction or 8 years gone to waste.

?— Hisham Fahmy (@fahmyeu) June 14, 2017

?— Hisham Fahmy (@fahmyeu) June 14, 2017Whether we like it or not, at this point not supporting BIP148 is the dangerous path. With most risks being to miners & services, not users.— Neo M. Atrix (@redpilltrading) June 4, 2017

Inclusion in Anti-Money Laundering Bill:

Last but not least, Senators Chuck Grassley (R-IA), Dianne Feinstein (D-CA), John Cornyn (R-TX) and Sheldon Whitehouse (D-RI) have co-sponsored bill S.1241 (Combating Money Laundering, Terrorist Financing and Counterfeiting Act), which adds language to existing anti-money laundering provisions to include digital wallets, prepaid access devices, and other ‘digital currency exchangers’ if they contain over $10,000 of cryptocurrency. Also included in the bill are cell phones, flash drives, and computers containing information on holdings which will need to be declared and reported upon entry into the U.S. In other words, the notion of using digital currency to transact anonymously will become much less attractive if this bill is signed into law.

Demand for cryptocurrencies has skyrocketed over the last few months, beginning with Japan recognizing bitcoin as legal currency in April. Other countries including South Korea and Malaysia are reportedly set to follow suit.

Chinese leader Xi Jinping has vowed to combat corruption among China’s business and political elite – a crackdown that recently led to the detention of the CEO of Anbang, China's hyperacquisitive insurance conglomerate. The company has been blamed for a sizable portion of China's merger spree between 2014 and 2016, and which has since been accused of being a money laundering vehicle, of wreaking "havoc" with the Chinese insurance market.